Interviews

The Holy Trinity? Three of the Most Important Men in the Swiss Watch Industry

*All information provided by Vontobel Luxury Groups Shop based on FY2017 information.

*Watch sales share refers to the percentage of business coming from watch categories.

Thierry Stern, President Patek Philippe

Despite helming the single most worshipped, revered and sought-after high watchmaking brand, a maison that has reached near mythological level and is capable of reducing even the most jaded of watch collectors to tears of joy with the allocation of a Nautilus Perpetual Calendar reference 5740, Thierry Stern is an affable, warm and genuinely understated man. However, the full measure of his vision for Patek Philippe, including the shift in the brand’s positioning to encompass a larger segment of sportier watches — everything from the now famous Calatrava Pilot Travel Time watches, Aquanaut Travel Time, Nautilus chronograph, World Time chronograph and even the vintage-styled luminous hand reference 5320 inspired by the water resistant perpetual calendar reference 1591 dating back to the ’40s — has been a huge hit in terms of connecting with a new generation of watch consumers.

Thierry Stern, President Patek Philippe

• Change (2017, compared with 2016): +4%

• Watch sales share: 100%

• Worldwide market share: 3.6%

[/td_block_text_with_title]

At some point, Harvard Business school needs to teach a course on how Patek Philippe became the most successful high watchmaking brand in China. To be fair, you would argue that from 1941 coinciding with the launch of the 1518 and 1526, Patek Philippe has been the single most significant and coveted watchmaking brand on the planet. The maison has been first and best in the vast majority of instances, from the first perpetual calendar chronograph made in series to innumerable horological achievements, including the first use of silicon in a traditional watch movement. And while Philippe Stern is one of the greatest watchmaking heroes of the 20th century — establishing Patek Philippe’s museum, the creation of the brand’s integrated manufacture at Plan-les-Ouates, the Caliber 89 and so much more — Patek Philippe was slightly late to entering the mainland Chinese market.

The Caliber 89, one of the greatest movements and clocks ever made in history

The Maison Patek Philippe Shanghai

The Maison Patek Philippe Shanghai

Education being a focus, Patek Philippe has consistently carried out exhibitions across the world to educate consumers on its tremendous watchmaking cachet

A historical image of Patek Philippe’s watch atelier. The brand maintains this atelier even today, with watchmakers working with a grand view of the Lake Geneva

Ref. 5711/1A

Jean-Frédéric Dufour, CEO Rolex

Many of us first met Jean-Frédéric Dufour following his tenure at Chopard, when he was tasked by Jean-Claude Biver to turn around Zenith watches. And many people forget what a massive and seemingly insurmountable challenge he had to face. This was following a period where LVMH Group had decided to push Zenith back into the spotlight as a brand rather than a movement manufacturer. And the man tasked to do this was a colorful character from the champagne industry named Thierry Nataf. Nataf’s initial collection of Open Heart watches were brilliant, featuring dials that revealed to the world the fast-beating 5Hz oscillator of the El Primero in a form of technical branding. But from there things quickly went sideways, culminating in a launch featuring Nataf being brought in from Dubai’s desert on a bed carried by bare-chested male porters, where they launched a non-functional watch named the Zero G. Simultaneously the designs of Zenith had become increasingly outré and with Nataf’s departure, it was Dufour’s task to turn things around.

Jean-Frédéric Dufour, CEO Rolex

• Change (2017, compared with 2016): +6%

• Watch sales share: 100%

• Worldwide market share: 14.1%

[/td_block_text_with_title]

Appointed to Rolex, a career move that had him essentially assuming the mantle of the single most important man in the watch industry, Dufour made the transition with class, adopting the correct self-effacing but steadfast character required of a Rolex CEO in the post Patrick Heiniger era. There are some who’ve complained to me of how Dufour was once easily reachable by phone or email but no longer so. But my response is, “What do you expect? He is the CEO of Rolex, the single most powerful entity in watchmaking. Did you expect him to still meet you for a chai latte if you want to have a whinge about Zenith?” In my encounters with him in his capacity as the head of the mighty green giant, I’ve never found Dufour to be anything but classy. It’s additionally important that you have a man heading Rolex who is from the same generation as the current Rolex customer. This generation alignment is important in general across the watch industry because previous to this, you essentially had a bunch of old white dudes who thought they knew what consumers in their 20s to 50s wanted.

But like Stern, Dufour has one problem: It’s become a challenge to access Rolex’s most popular models at retail. It’s a bigger issue for Rolex than Patek Philippe, as the scale of Rolex’s business is much larger. It was recently fed back to me that there have been some eyebrows raised at Rolex’s headquarters that I don’t wear any of the more recent Rolex models. Well, to be honest I love them. They are some of the best damn watches and greatest Rolexes that have ever been made! Hell, I’d love to wear the ceramic bezel Daytona, a root beer GMT Master II or the white gold, blue-dialed model or the steel Pepsi edition. Not to mention the Rainbow Daytona and a huge host of Rolex’s other watches.

Cosmograph Daytona “Rainbow” in Everose gold

I find it amusing that there are still some people scratching their heads and wondering why Rolex sports models of any kind are unavailable at any authorized dealer or boutique. I’ve heard theories that because of the relaxation of work dress codes men are eschewing the traditional dress watch for sports models. And there is some credence to that. However, the two biggest factors that you cannot find any sport or steel Rolex anywhere is that — as Mike Tay explains, for the first time we’ve had a total global alignment in watch tastes.

Stainless steel Cosmograph Daytona

The second reason, as expressed by Tay, is that since 2011 coinciding with Gian Riccardo Marini and through to Jean-Frédéric Dufour’s reign, beginning in 2014 at the helm of the most iconic brand in watch history, Rolex has absolutely been on fire from a product and marketing perspective. It has been making some of the best watches in the history of the brand. The ceramic bezel Daytona 16500 LN with a subtle tip of the hat to the 6263 Big Red, the steel Pepsi GMT-Master II, the Root Beer and the Rainbow Daytona are some of the most desirable luxury products (transcending the watch category) on the planet.

Stainless steel GMT Master II “Pepsi” with red and blue ceramic bezel

But at the same time, success has been a double-edged sword for Rolex, with many customers becoming frustrated by the endless wait lists and constant “out of stock” replies from boutique staff. This is exacerbated by the fact that pretty much any model you want is available on the secondary market on platforms like the Richemont-owned Watchfinder at a hefty premium. Collectively, this could create a perceived arrogance related to the attitudes of staff as well as watch owners, the implication being you need to be wealthy enough to pay the premium to own such a watch. The balance between desire and frustration is the issue that Dufour needs to solve.

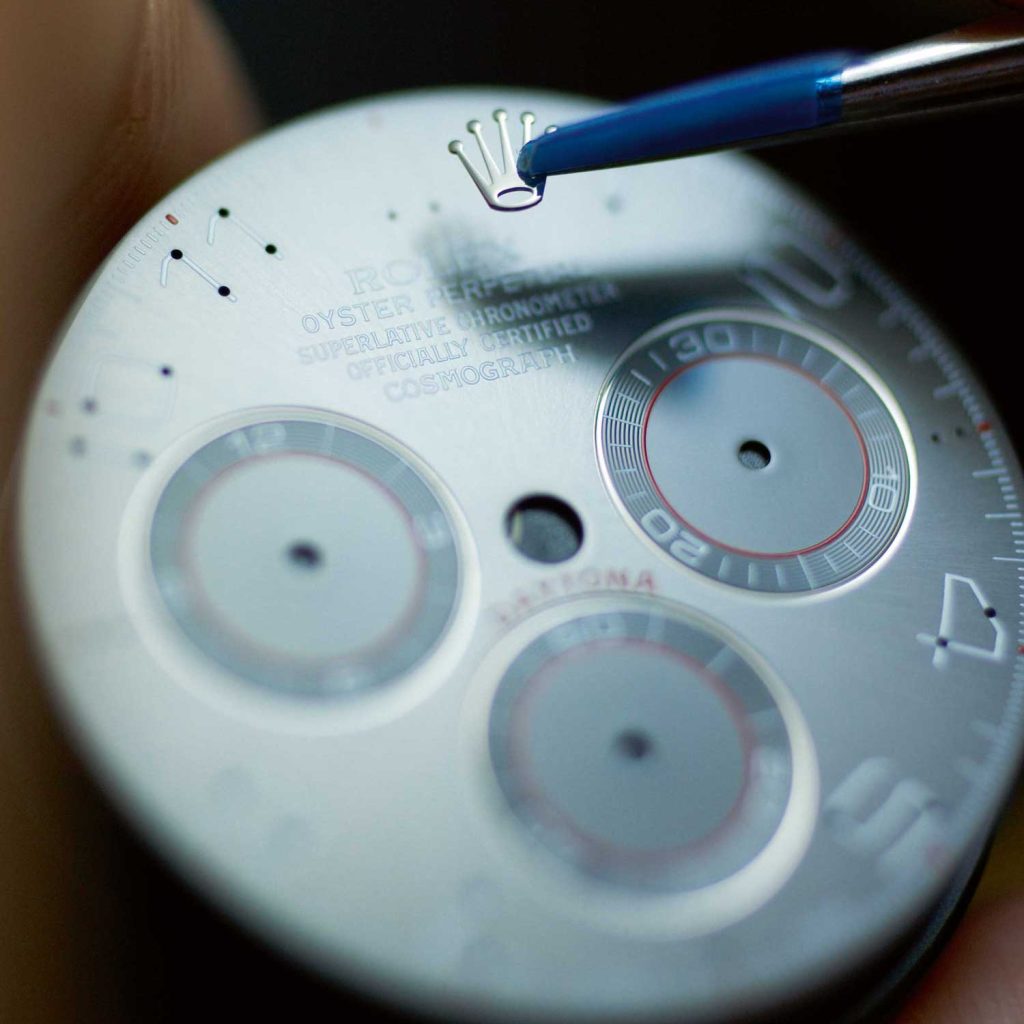

A watchmaker is applying the brand’s logo on a Daytona dial

Jérôme Lambert, CEO Richemont Group

Jérôme Lambert is a both a man I admire immensely and someone who, at several moments in my life, seemed determined to kill me. I don’t mean that euphemistically. I mean physically kill by simply driving me to the brink of exhaustive annihilation. And for those of you reading this who work directly under him? Respect, my sisters and brothers. Respect.

Want an example? I once flew 40 hours from Singapore to Buenos Aires for a Jaeger-LeCoultre watch launch. Arrived at the airport and was brought straight to a polo match. Then had a presentation of the new watches. Went back to the hotel, checked in. Came downstairs for the welcome cocktail. Had dinner, then was invited to a salsa lesson. The next morning I was told to rise at five a.m. to be downstairs by six a.m. Took a bus to a private airport. Got onto a plane for Ushuaia, the southernmost region in Argentina. Got off the flight and was brought on a boat for a ride during lunch. Got off the boat and went for a nature hike. After the hike, I was transported to a cocktail with a second presentation of the new watches. Had dinner. Went back to the airport and got on the plane for Buenos Aires.

At three a.m. Isabelle Gervais, the head of communications for Jaeger-LeCoultre, tapped me on the shoulder and said: “Jérôme is ready for you to interview him.”

Jérôme Lambert, CEO Richemont Group

• Change (2017, compared with 2016): +5%

• Watch sales share: 41%

• Worldwide market share: 13.5%

[/td_block_text_with_title]

My point is that with Lambert at the helm of Richemont, you can only expect his foot to be firmly planted on the gas pedal with the idea of creating greater distance between the group and its competition. He is like Sugar Ray Leonard in his prime. Brilliant and relentless and will swarm you with such a dazzling combination of combustive shots before you see them coming.

And where does Richemont Group have first-mover advantage? In luxury e-commerce with their €2.1 billion revenue, YOOX Net-a-Porter juggernaut which accounted for a considerable amount of the group’s growth in FY2017. Never one to be satisfied with mere organic growth, the group is poised to post exponential growth through its joint venture with Alibaba group signed last October.

The YOOX Net-a-Porter Group is Richemont’s most recent acquisition, along with a host of other brands in luxury fashion, watchmaking and jewelry

Interestingly, this gives the group immediate access to watches from Rolex, Patek Philippe, Audemars Piguet, Richard Mille and Omega, which Watchfinder acquires through pre-owned channels. And though these are sold at premium, it also means they are able to offer consumers the very same hotly contested models such as the Rolex Daytona, Patek Nautilus 5711, Audemars Piguet Royal Oak Ultra Thin or Richard Mille RM 011 that are almost constantly out of stock at authorized dealers or the brands’ own boutiques. Integrating these models with the new offerings from the group’s brands would create the world’s most comprehensive array of luxury watches in existence.

Cartier’s maisons are highlights of the brand and the group, contributing to its great success

Other brands that impressed me big time at SIHH were A. Lange & Söhne, IWC and Vacheron Constantin; hats off to their CEOs Wilhelm Schmid, Christoph Grainger-Herr and Louis Ferla. Panerai is reuniting with its own military heritage with the Marina Militare, while Roger Dubuis seems to have found its perfect audience in its tie-up with Lamborghini. Indeed the strong collective showing demonstrate that Lambert has managed to overcome challenges both within and outside of the Richemont group. One brand that still requires remedy is Baume & Mercier, which is a shame because the “value” category of Swiss watches represented by Longines, Hamilton, Oris and Tudor is one of the most exciting today. But knowing Lambert, expect everything within the group to fall into alignment quickly as he moves to stage even more impressive innovations in the year ahead.